Where to Invest in Shaky Markets?

Private credit is Where the Smart Money is Headed.

South African investors are navigating a minefield of market swings. From global uncertainties, like the fallout of Trump’s trade war, to the rand’s relentless rollercoaster, building a stable portfolio can feel like a constant balancing act.

But what if there was a way to introduce an element of calm, even when the markets are anything but?

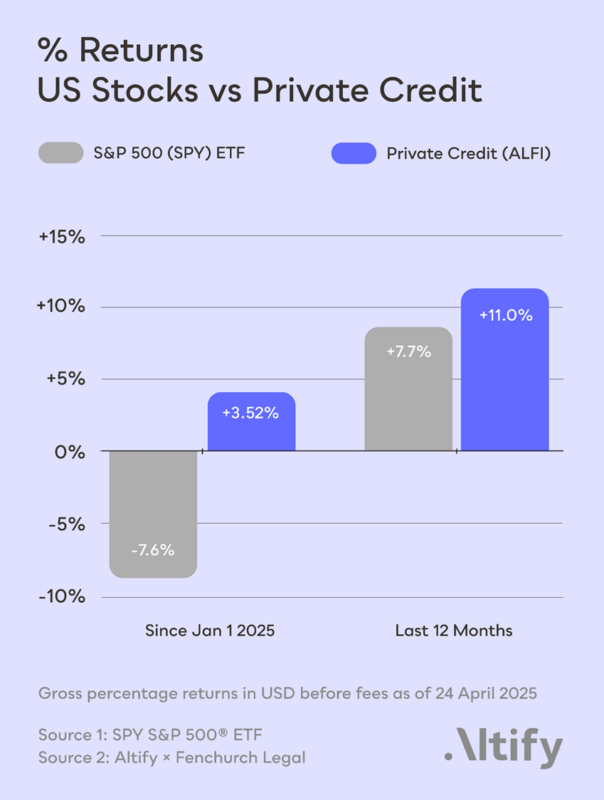

The answer for many savvy investors lies in an investment category that is outperforming the broader US stock market that you might not hear about every day: private credit, also known as private debt or direct lending.

- Investors can learn more by visiting https://www.altify.app.

About Private Credit Investing

It is called private credit because the debt is not issued or traded on public markets — such as stock exchanges — and usually involves directly lending money to carefully vetted businesses.

Often, many investors pool their capital with a fund manager to lend to a diverse range of businesses, which helps reduce risk. The result can be attractive and stable annual returns in USD, typically between 8% and 15%, paid out regularly.

So, while stock investors buy a piece of a company’s equity, private credit investors essentially become the bank, providing the loan capital.

Borrowers use private credit for a couple reasons. They may not have easy access to funds through traditional financing channels, or might prefer to work with a lender who can offer more flexible terms and faster loan processing than a bank.

Private credit is a core holding in institutional and wealthy individual investment portfolios. The problem is that investing in private credit has historically been inaccessible, with minimum investments often in the millions and multi-year lock-up periods.

Until now…

Investing in Private Credit WIth Altify

Cape Town-based Altify (FSP: 53289), backed by JSE-listed Sabvest, has opened the doors for South Africans to invest in the same opportunities as the ultra-wealthy have for decades

You can get started with an investment as low as R1,900* into their private credit offering called ALFI, which provides a fixed 11% USD annual interest rate with quarterly interest payments.

ALFI Investment Highlights

What is ALFI?

ALFI stands for Altify Legal Finance Investment and provides fractionalised access to a diversified portfolio of loans made to law firms in the UK. The investment is managed by a leading UK-based specialist lending firm, called Fenchurch Legal, which lends specifically to vetted UK law firms.

Investors can learn more by going to https://www.altify.app/legal-finance.

Altify’s investment app and web platform makes investing in private credit opportunities and other alternative investments like gold and ETF-style crypto portfolios, as easy as shopping online.

Considering ALFI? Here’s What to Know.

Sean Sanders, CFA® Charterholder and CEO of Altify, explains:

“The significant interest we’ve received in ALFI isn’t a surprise. It delivers higher returns than typical savings accounts or fixed income bonds, offers stability during market swings, provides crucial rand-hedged USD exposure, and does a remarkable job of diversifying your investment portfolio.

However, it’s vital to understand that higher returns come with risk. While Fenchurch Legal has a strong track record and has never missed an interest repayment, this isn’t a risk-free investment. Do take the time to review the risks outlined on our website and do your own research before investing.

Also, while you can request access to exit your ALFI investment early with 14 days’ notice, these early redemptions depend on market conditions, so they can’t always be guaranteed within this time frame. This means ALFI is generally a better fit for those with a longer investment horizon.

Our aim at Altify is simple: to give everyday South Africans access to carefully vetted alternative investments, so they can grow and protect their wealth just like the ultra-wealthy. We’ve set a low minimum investing amount so you can start small, see how it works for you, and add to your investment as you become more confident.

Ready to explore how private credit could fit into your investment strategy? Discover ALFI with Altify by visiting www.altify.app.

Important Notes

* Investment Amount: Since this is a tokenised investment, a minimum of 100 USDC or 100 USDT is required. This roughly equates to R1,900 at the time of writing.

† Early Redemption Notice: You can apply to redeem your ALFI tokens before the maturity date with 14 days’ notice. However, redemptions are subject to market conditions and cannot be guaranteed. If your request is approved, a 5% early redemption fee will apply to the total invested amount, including unallocated accrued interest.

Investment Risk Disclosures & Disclaimers

Altify SA Capital (Pty) Ltd (FSP 52727) and Altify SA DAS (Pty) Ltd (FSP 53289) are both authorised financial services providers.

This article is provided solely for informational purposes. The opinions expressed herein do not constitute investment advice or recommendations, nor should they be regarded as such. This document does not represent an offer to buy or sell, or a solicitation of an offer to buy or sell, any of the tokenised private credit products mentioned.

Altify operates as a brokerage service facilitating the reception and transmission of orders for alternative investments, including tokenised private credit products, without providing investment advice or personalised recommendations. While Altify promotes the accessibility of alternative investments, they may not be suitable for every investor.

It is important to carefully consider your investment goals, experience level, and seek independent financial advice when necessary. Altify strongly recommends conducting thorough research before investing in private credit or tokenised financial products.

Investors are solely responsible for their investment decisions. Given the risks associated with private credit, including illiquidity, borrower default, and market volatility, you should assess your financial circumstances before engaging in these transactions. Private credit carries risk, with the potential for both significant gains and losses. Investing in private credit may result in a total loss of capital.

Past performance is not indicative of future results, and returns cannot be guaranteed as the value of private credit investments may fluctuate based on borrower performance, market conditions, and other factors. Only invest funds you can afford to lose, and seek professional guidance if you are unsure about the suitability of a private credit investment for your specific situation.

Please refer to the General Risk Disclosures and Private Credit Risk Disclosures on Altify’s website for more information. Investments should only be undertaken by individuals who fully understand these risks.

For additional details, please visit www.altify.app.