South Africans saying goodbye to plastic bank cards

Virtual card adoption is increasing among South African consumers, as they begin to realise the safety and convenience benefits the payment technology can offer.

According to a Visa and Discovery Bank survey, forming part of the SpendTrend25 report, 45% of roughly 1,000 cardholders use virtual cards, while some respondents own virtual cards but don’t use them.

“Virtual cards are gaining popularity as a secure and convenient payment method,” the report reads.

It adds that the fact that some people own virtual cards but don’t use them indicates a need for more education on the benefits of virtual cards.

According to Discovery Bank, the benefits include heightened security, convenience, and versatility.

“Like physical cards, they can be used in-store, online, and in-app, but with added safety to protect sensitive information,” it said.

“Virtual cards are even more convenient as these cards are issued to clients instantly in their banking app, allowing clients to transact immediately as opposed to waiting for a physical card to be delivered.”

It added that fraudsters are becoming more sophisticated when it comes to targeting online payments.

“Virtual cards are increasingly being favoured for their enhanced security and control over spend, making them a top choice for digital transactions,” Discovery Bank stated.

FNB agrees that virtual card usage is increasing rapidly in South Africa.

According to Ashley Saffy, head of spend and customer value management for FNB Card, 7.2 million FNB virtual cards have been created since they first launched in July 2020.

She added that the total spend on virtual cards since their inception had reached R111.2 billion as of 28 February 2025.

“Between FY23 and FY24, the ranking of top retail virtual card categories remained consistent, with groceries leading the list, followed by eating out and treats, fuel, general retail, and travel and holidays,” said Saffy.

Despite the consistency in the top categories, year-on-year growth rates for each varied significantly.

“Groceries experienced the highest growth at 121.5%, while travel and holidays followed closely with 115%,” said Saffy.

“Eating out and treats grew by 98.3%, general retail by 75.4%, and fuel saw the lowest growth at 66.9%.”

The SpendTrend25 report, which leverages five years of spending data, also revealed that digital wallet usage for in-store payments has grown significantly in recent years.

Digital wallets’ share of in-store payments grew by 9% in 2024, matching 2023’s increase.

Citing the PayFast State of Pay 2024 study, Discovery Bank noted that digital wallets like Apple Pay and Samsung Pay now account for 22% of transactions.

It added that this figure is expected to rise as most customers prioritise speed, simplicity, and security.

“This shift is especially strong in Johannesburg and Cape Town, where digital payments are becoming the norm,” said Discovery Bank.

“The Visa Stay Secure Study 2025 reports that 68% of South Africans plan to use digital payments even more in the next year.”

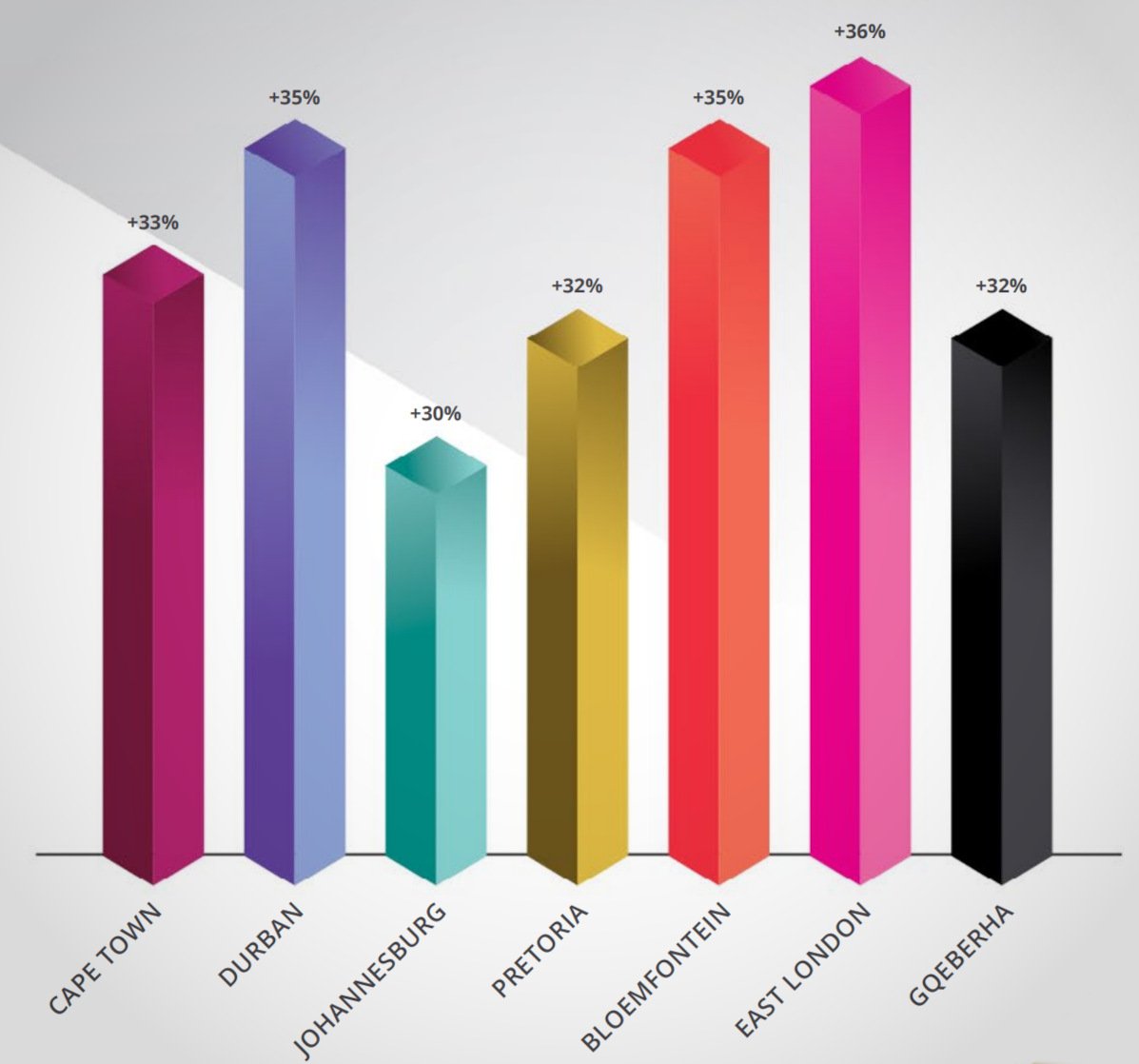

The chart below shows the growth of the average digital wallet spend per active card across major metros in South Africa from 2021 to 2024.

Banks encouraging customers to ditch physical cards

Several major South African banks want their customers to embrace digital wallets and virtual cards over physical plastic cards as they offer improved security, among other benefits.

Saffy previously told MyBroadband that FNB’s digital wallet volumes and values had increased by 74% and 77%, respectively, between 2023 and 2024.

“The rapid growth in digital wallet adoption demonstrates their importance in the financial ecosystem,” Saffy said.

“With increasing transaction volumes and values, digital wallets are shaping the future of payments by offering a secure, convenient, and eco-friendly alternative to physical cards.”

She added that 1.27 million of FNB’s 8.6 million customers had adopted physical wallets, which are “far more secure” than physical cards.

“They require biometric authentication, such as fingerprint or facial recognition, or passcodes before authorising transactions,” said Saffy.

“Even if your smartphone or wearable is stolen, unauthorised access is nearly impossible due to these safeguards.”

She added that digital wallets use tokenisation technology, replacing sensitive card details with device-linked tokens, which makes it difficult for fraudsters to exploit stolen credentials.

“Unlike physical cards, which can be misused if lost or compromised, digital wallets offer advanced encryption for payments and eliminate risks like skimming or PIN theft,” Saffy stated.

Discovery Bank and Standard Bank also told MyBroadband that they encourage the adoption of digital wallets over digital cards for an improved customer experience, heightened convenience, and better security.