Warning to criminals who want to hide money in crypto in South Africa

South Africa is cracking down on financial crimes, and cryptocurrency platforms—including Binance, the largest crypto exchange in the world—are working with law enforcement to bring offenders to justice.

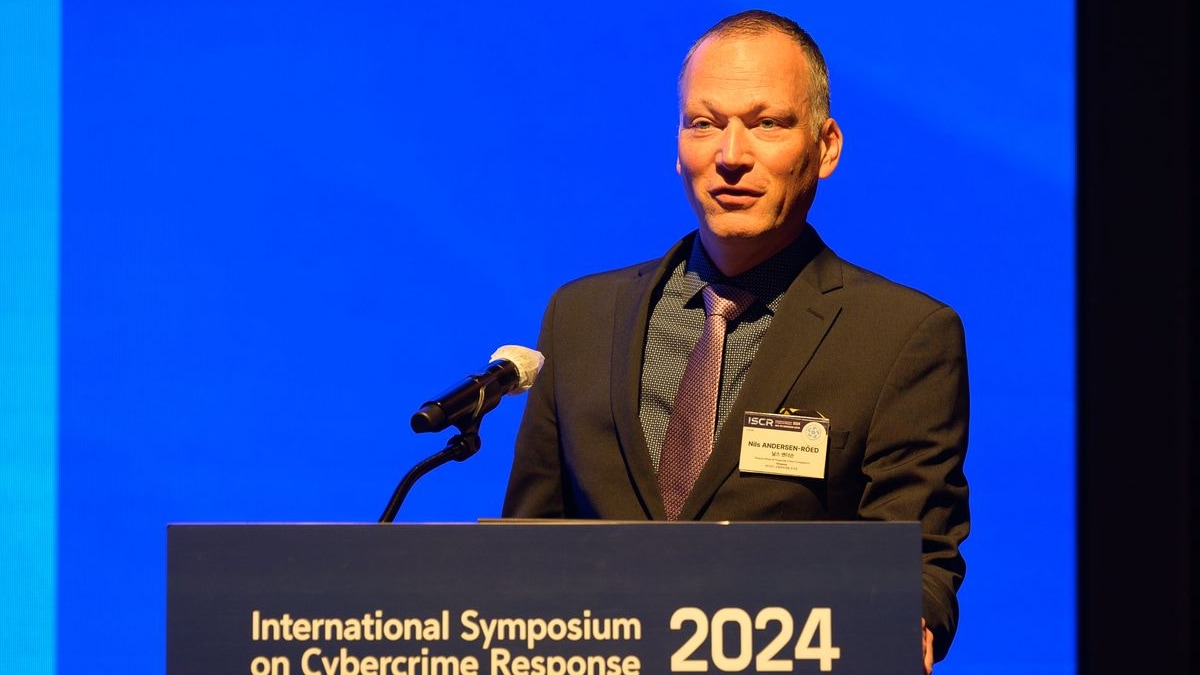

“In South Africa, we’ve partnered with local authorities, conducting training for over 35 officials to help combat crypto-related crimes,” the head of Binance’s global Financial Intelligence Unit, Nils Andersen-Röed, told MyBroadband.

“Binance employs advanced encryption, secure data storage, and AI-driven monitoring tools to safeguard user information,” Andersen-Röed said.

“In addition to data protection, Binance has a dedicated team that will verify incoming requests from law enforcement authorities and check whether or not they are valid and proportional.”

Andersen-Röed added that Binance maintains strong working relationships with law enforcement agencies worldwide.

“We have a global compliance and investigations team with over 750 professionals, including experts from law enforcement and blockchain analysis firms,” said Andersen-Röed.

“Additionally, Binance hosted more than 100 anti-cybercrime workshops for investigators globally, including engagements across Africa, to equip officials with the latest tools and knowledge in tackling crypto-related crimes.”

South Africa’s clampdown on financial crime is part of an effort to get off the Financial Action Task Force (FATF) greylist.

The FATF greylisted South Africa on 24 February 2023 for falling short on its eleven measures of a country’s effectiveness in combating money laundering and the financing of terrorism.

It highlighted 22 specific shortcomings, which South Africa has taken steps to address.

One of the steps the Financial Intelligence Centre took last year was issuing Directive 9, which will require crypto platforms in South Africa to identify the parties to a cryptocurrency transaction.

This is an implementation of the FATF’s “Travel Rule”, which requires financial institutions, including those who deal in virtual assets, to provide relevant originator and beneficiary information alongside transactions.

According to the FATF, this helps to prevent criminal and terrorist misuse.

Asked about this regulatory change, Andersen-Röed said Binance supports regulatory developments that enhance the security and transparency of the digital asset ecosystem.

“The implementation of the FATF’s Travel Rule in South Africa aligns with global trends in strengthening financial security and compliance,” he said.

“Binance has proactively developed and integrated Travel Rule solutions to ensure seamless compliance while maintaining user privacy and security.”

In addition to implementing the Travel Rule in South Africa, the Hawks arrested a man in January on charges of terrorism financing.

The 35-year-old, Ziyadh Hoorzook, was brought up on charges for a R11,500 Bitcoin transfer he made in 2017 to an organisation called al-Sadaqah.

He has been charged with contravening the Protection of Constitutional Democracy Against Terrorist and Related Activities Act (POCDATARA).

Hoorzook told the court that he intended to plead not guilty and that the case against him had been exaggerated.

He maintains that he had donated innocently to what he believed was a charitable organisation.

“The state has misaligned me to a narrative which is factually untrue,” he said.

Hoorzook was released on R30,000 bail after the Lichtenburg Magistrates Court ruled that he was not a flight risk. His case is scheduled to resume on 3 March.

National Treasury has called for public comment on proposed amendments to laws with the aim of further strengthening the country’s Anti-Money Laundering and Counter-Terrorism Financing legislation.

BusinessTech reported that South Africa has now largely or fully addressed 16 of the 22 items the FATF highlighted in 2023.

This leaves six items to be completed by its next report, which is due in the coming months.

In hopes of addressing outstanding deficiencies by its next reevaluation, National Treasury recently published the draft General Laws (Anti-Money Laundering and Combating Terrorism Financing) Amendment Bill.

Among the changes being proposed are raising penalties and expanding regulatory oversight to better align with international standards.

Fighting money laundering, fraud, and scams

Andersen-Röed said Binance was in full compliance with South Africa’s FICA, POPIA, and POCDATARA legislation.

He also said Binance was proud of its achievements in helping law enforcement tackle crypto-related crimes.

“Our collaborative efforts led to the dismantling of a multi-million-dollar criminal syndicate in Hong Kong, which used virtual assets for illicit activities and was linked to multiple fraud cases.”

With Binance’s assistance, Andersen-Röed said authorities arrested several individuals, including the group’s leader and key members, effectively shutting down their operations. Similar successes unfolded across Indonesia, India, Malaysia, Thailand, and the Netherlands.

Asked whether Binance believed it had a role to push back against government and law enforcement overreach, Andersen-Röed said they rather advocate for a balanced regulatory framework that ensures the protection of users while fostering innovation.

“We work closely with regulators to create clear, fair policies that help maintain the integrity of the crypto industry,” he said.

He also reiterated that Binance’s law enforcement team checks the legality and proportionality of requests and reach out to authorities as and when needed.

Regarding their approach to scams, Andersen-Röed said their Special Investigations team, which is primarily composed of former police investigators, proactively researches networks of pyramid schemes and Ponzis.

They then identify and dismantle them in collaboration with law enforcement.

“Our ultimate goal is to protect our users and enhance the safety of the crypto ecosystem,” he said.

“Additionally, we partner with various private and public entities and provide training sessions to law enforcement, sharing our expertise and experience.”

Binance also helps users recover funds lost to cybersecurity incidents and other forms of theft.

“In 2024, our dedicated teams facilitated the recovery of $88 million worth of crypto assets linked to hacks, exploits, and theft, even when most incidents occurred on external platforms,” Andersen-Röed said.

“As long as Binance has the means to help, we remain committed to doing everything possible to support our valued users in reclaiming their assets.”