Big trouble at Vumatel and DFA

Remgro is reporting deepening losses at Community Investment Ventures Holdings (CIVH), the parent company of Vumatel and DFA.

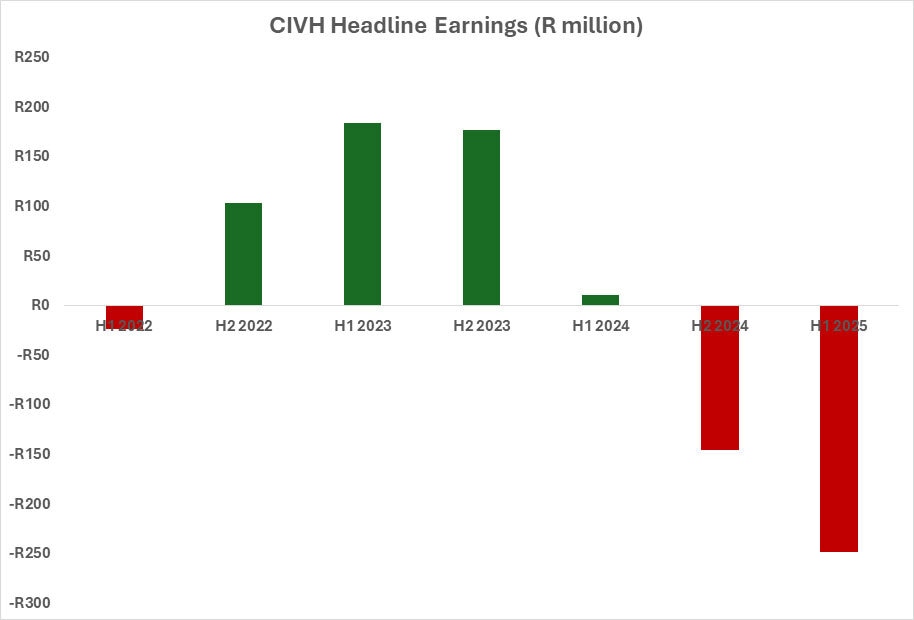

For its half-year results, Remgro reports that CIVH made a R247.4 million loss during the six months between 1 April and 31 September 2024.

This indicates a worsening trend at the company, which reported a full-year loss of R134 million last year after recording a half-year profit of R10.5 million.

Remgro, which owns a 57% stake in CIVH, explained that the worsening decline was mainly due to increased borrowing costs.

These were caused by higher average debt balances and a negative fair value adjustment on an interest rate hedge, totalling R232 million.

The increasing losses as a result of borrowing costs should be cause for alarm.

If a company has spare cash, it can cover losses for a while, but eventually, either debt or equity is needed to fund them.

If losses get out of control, there is a risk the company could enter a death spiral where it is forced to take on more debt to cover its losses.

This leads to a vicious cycle of ever-increasing expenditure to repay debt while taking on more debt to cover escalating borrowing expenses.

In CIVH’s case, the issue is the roughly R20 billion in debt, most of it belonging to Vumatel, which it incurred in rolling out South Africa’s biggest fibre-to-the-home network.

One way out of this debt trap for CIVH is an offer from Vodacom to acquire 30% of the company for a combination of cash and fibre assets, with a minimum of R6 billion being cash.

However, the Competition Tribunal has blocked the transaction, citing anti-competitive concerns.

This was despite 20 months of back-and-forth with the Competition Commission that culminated in a host of conditions that would be attached to the deal.

The Commission recommended to the Competition Tribunal in August 2023 that the transaction be prohibited.

The Tribunal then conducted weeks of public hearings, which concluded at the end of September 2024.

A month later, it issued its decision, and the transaction was blocked. It has yet to publish the full reasons for its decision.

Deal Leaders International CEO Andrew Bahlmann has described the Competition Tribunal’s decision as a red flag to foreign investors looking at South Africa.

However, another major issue was how long it took. Vodacom made its offer in November 2021 and it took three years to be rejected.

In the meantime, CIVH is in limbo — waiting for the Competition Tribunal to issue its reasons so all the players can decide whether to appeal the ruling.

Minister, Vodacom, and Maziv lodge appeals

Vodacom, CIVH through subsidiary Maziv, and trade and industry minister Parks Tau have filed their intentions to appeal the ruling pending the release of the Tribunal’s reasons document.

Responding to a Parliamentary question, Tau explained that Vodacom and Maziv had agreed to substantial public interest conditions.

These would have boosted investments and growth of fibre and mobile connectivity in South Africa, Tau stated.

He said the conditions Vodacom and Maziv agreed to were in line with South Africa’s priorities for industrialisation and investment to foster economic growth and create jobs.

“Once the Tribunal’s reasons are made available, the Minister will assess and advise whether he will proceed or withdraw the appeal,” Tau’s department said.

Tau explained that he would consider the Tribunal’s reasons for the prohibition against the significant positive public interest outcomes offered by Vodacom and Maziv.

Still some road left

While there are warning signs at CIVH, Remgro said the group remains operationally cash-generative.

“CIVH continues to reinvest any excess operating cash flow and capital into expanding its operations and network footprint, whilst continuing to limit overbuild in key markets,” Remgro stated.

It reported that CIVH’s revenue for the six months ended 30 September 2024 increased by 7.9% to R3.4 billion, up from R3.1 billion the period before, supported by subscriber uptake growth at Vumatel and increased demand for DFA’s fibre-to-the-business products.

Earnings before interest, taxation, depreciation, and amortisation (Ebitda) from continuing operations have increased by 6.5% from R2.1 billion to R2.2 billion.

Remgro said this was driven by revenue growth as demand from enterprise and retail customers contributed to increased uptake.

“The CIVH group has increased its spending on security related and maintenance costs in order to ensure the safety of its workforce and maintenance service provider staff in the field, while maintaining a high standard of network uptime and service levels,” it said.

“These additional costs have resulted in a slight erosion in its Ebitda margins against the comparative period, but is expected to normalise over the near term.”