Bookings trouble for smart ID card and passports at banks

Several major South African banks offering smart ID card and passport applications have confirmed a shortage of booking slots, potentially due to the popular service’s continued restriction to just a handful of branches.

In the past year, the Department of Home Affairs (DHA) has repeatedly warned that it plans to phase out the green ID book and fully replace it with the smart ID card.

The green ID book has become a soft target for identity thieves and fraudsters due to its outdated anti-tampering features.

In the wake of its vague warnings about the end of the green ID book, there has been a surge in smart ID card applications, with 2.65 million issued in the first three quarters of the last financial year.

The department recently said it was on track to deliver a record 3.6 million smart IDs for the entire financial year ending March 2025.

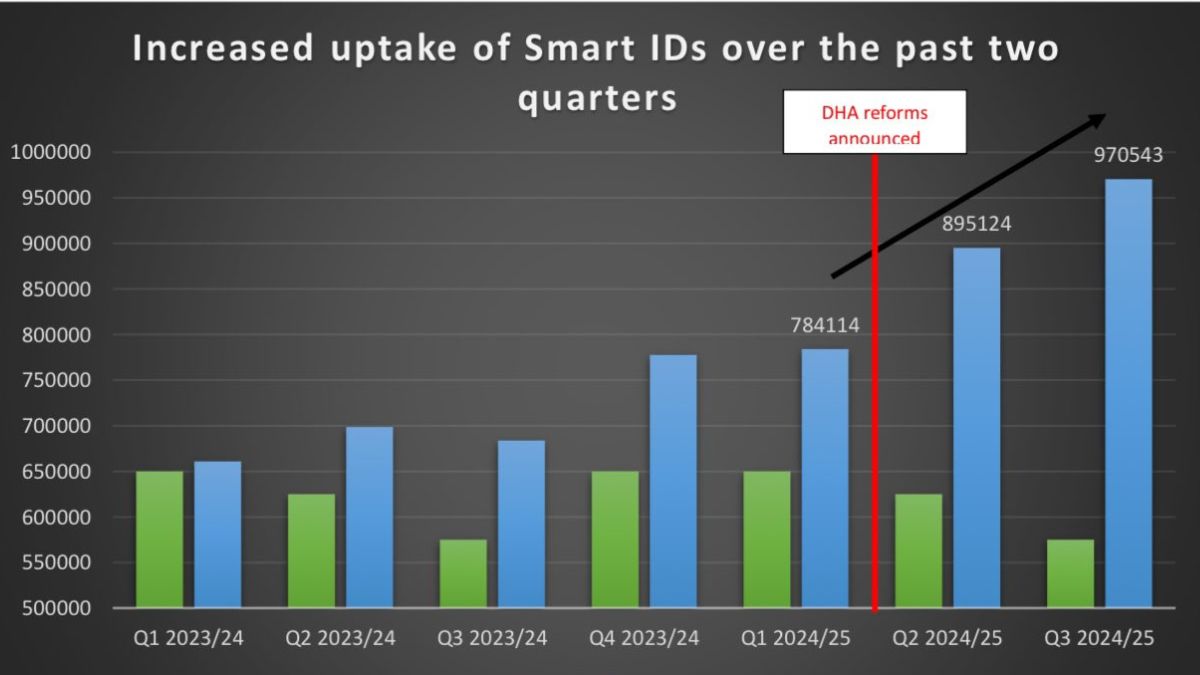

Apart from a small dip in the third quarter of 2023/2024, the number of cards issued has increased quarter-on-quarter from just over 650,000 between April and June 2023 to 970,543 between October and December 2024.

Home Affairs minister Leon Schreiber has attributed the increase to “growing public confidence” in the department’s reform agenda.

“I want to congratulate our teams working in front offices, banks, malls and at Government Printing Works for handling this significantly increased demand,” the minister said.

The bank-supported eHomeAffairs service is one of the channels facilitating smart ID card applications.

It has received high praise from many users for its convenience and efficiency since its introduction in 2016.

However, one of the major problems banks have had with the service in its current form is that many of its aspects are outside their control.

Many members of the public believe that the banks are running the service when their role is limited to providing physical space and waiting areas for applicants.

The online applications process and platform, appointment bookings, and in-person biometric authentication and collections are done by DHA teams using the department’s equipment and systems.

One aspect of this process that has misbehaved intermittently is the one-time PIN not being delivered when users try to log into the system.

Another issue that has started to emerge in recent weeks is a shortage of appointment slots for biometric authentication, likely due to the number of branches supporting the service stagnating around 30 in recent years.

With the influx of people applying for smart ID cards, some bank branches regularly experience prolonged periods without no available openings.

Several MyBroadband readers have recently complained that they are struggling to get booking slots.

That included two Durban residents who had already paid for their smart ID card and passport applications at the FNB Cornubia branch but could not find an open slot for 10 days.

MyBroadband asked the major banks supporting the service whether their branches were being inundated with demand.

Discovery Bank, FNB, and Standard Bank confirmed that increasing demand was driving up complaints about appointment availability.

The banks emphasised that the appointment scheduling system was managed by Home Affairs.

“Even though the DHA teams are in our branches, they operate as a standalone DHA branch,” said FNB Points of Presence CEO Zibu Nqala.

“We assist customers as much as possible, but the system utilised is the eHome system managed by Home Affairs.”

Discovery Bank told MyBroadband that its next available open slot for smart ID card or passport applications was more than a month away.

“While we cannot comment on other banks, our next available appointment is on 7 May 2025,” the bank said.

“Discovery Bank tends to be busy with applications all throughout the operating hours of our branch.”

While Discovery Bank currently has just one eHomeAffairs-supported branch at its headquarters in Johannesburg, it also has a much smaller customer base than the other banks.

Absa’s managing executive for integrated channels, Tshiwela Mhlantla, has also acknowledged that DHA issues have impacted users’ impressions of the bank.

“Customers who may not fully understand the relationship between the department and the participating banks sometimes perceive any challenges with the DHA service as a reflection of the bank,” Mhlantla.

Mhlantla said Absa remained fully committed to the DHA partnership and said any concerns regarding the service had been communicated through the Banking Association of South Africa (Basa).

Long wait for final PPP

Basa has been tasked with negotiating the private-public partnership agreement aimed at expanding the service to more bank branches.

This process has dragged on for several years, with little tangible information from the department on when it will be finalised.

In the latest feedback from Basa, the main agreement was said to be finalised while the association and the department’s committee structures were still working through its annexures.

The PPP will give banks more responsibility within the eHomeAffairs process — including appointing staff to handle the biometric authentication and collections processes.

Absa, FNB, Discovery Bank, and Nedbank have confirmed they want to expand the service to a combined 34 new locations, while Standard Bank will not commit to any plans until the PPP is finalised.

The Home Affairs department did not respond to MyBroadband’s questions about the booking slot shortages.