Shein under siege in South Africa

New research by Slant Research revealed that Shein’s market share in South Africa has declined significantly since 2024 due to the revised import duty regime.

Slant Research is a Cape Town-based research and analytics company which uses data from non-traditional sources.

“Applied correctly, alternative data can complement existing processes and give your company the edge in the market,” it explained.

Slant partners with data owners to monetise their non-core data, through which it provides relevant, differentiated information to help guide strategy.

Its goal is to identify clusters of valuable data and combine them into a unique view for its clients, which includes major South African retailers.

In a recent research note, Slate said Shein has been losing its shine following a crackdown on Chinese online retailers.

Shein, a Chinese fast-fashion retailer, has seen a rapid surge in popularity since it entered the South African market in 2020.

It has had such an impact that South Africa’s dominant eCommerce player, Takealot, sold its fast-fashion retailer, Superbalist.

It is widely accepted that Takealot viewed Shein and Temu as fierce competitors that would make it challenging to run Suparbalist profitably.

Shein has also been accused of exploiting import tax loopholes in South Africa to undercut local retailers, and the local industry campaigned for stricter duties on purchases from the retailer.

In March 2024, the Department of Trade, Industry and Competition announced that it was investigating Shein for potentially avoiding import taxes.

It reportedly abused the ‘de minimis’ rule, which allowed parcels containing clothing under R500 to pass through customs with a 20% import duty payment and no VAT.

Local retailers have always had to pay 45% customs duty and 15% VAT on all imported clothes, which puts them at a significant disadvantage.

SARS has decided that Shein and Temu could no longer rely on the de minimis rule. Since 1 July 2024, shoppers must pay the standard import tax on all orders.

Shein taking pain in South Africa

Slant Research explained that Shein’s market share has declined significantly since the new tariff regime took effect in 2024.

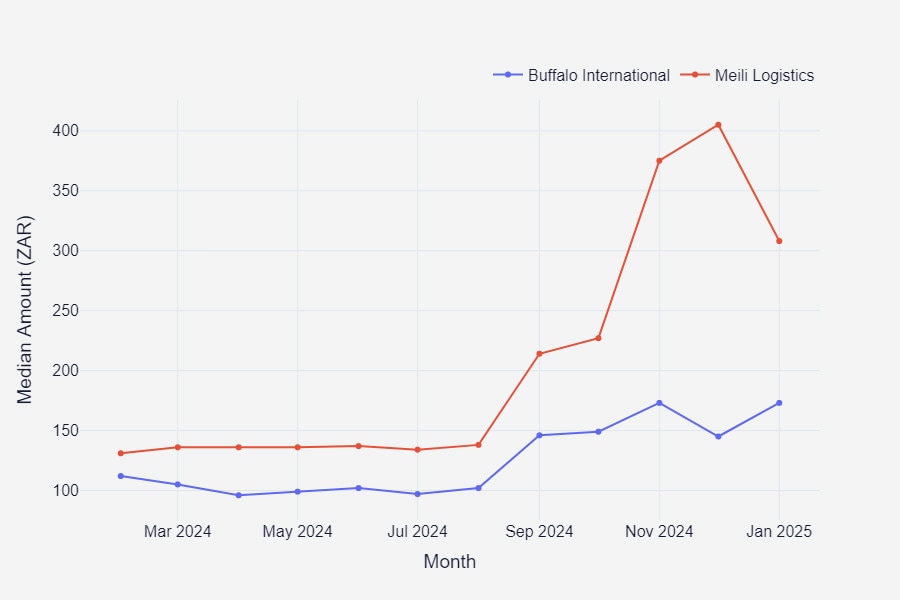

“According to our data, import duty and VAT payments on Shein orders are facilitated by third parties like Buffalo International and Meili Logistics,” it said.

The charts below show a significant increase in the median value of payments to these companies from September 2024.

This data suggests that the government regulations have had a meaningful impact on Shein’s sales.

However, despite the increase in payment value, Slant Research also noted that enforcement appears to have declined.

“Our data shows fewer payments to logistics providers as a proportion of total purchases,” Slant Research said.

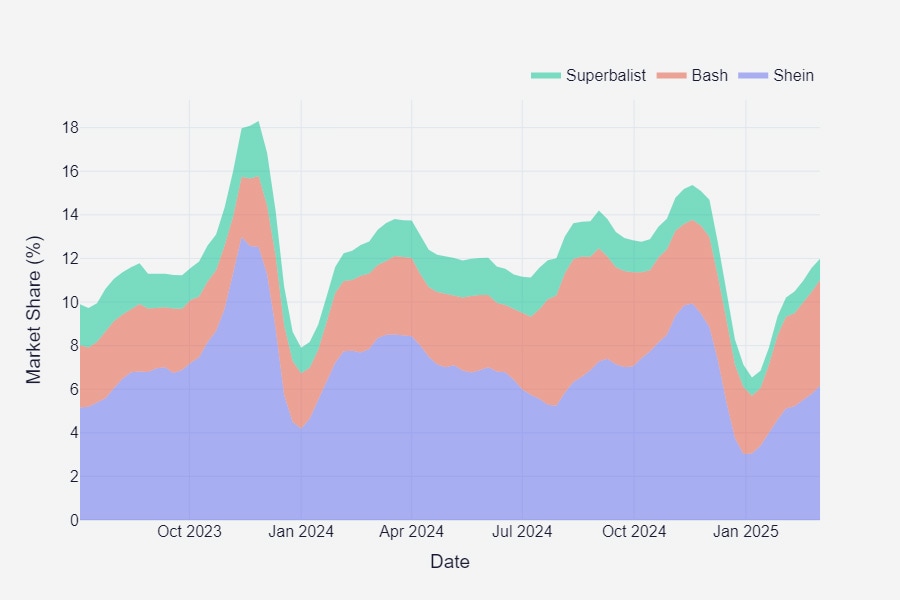

The charts below show Shein’s median transaction amount and how its market share has changed over the past three years.

“It’s clear that Shein did not achieve the same level of market share at the end of 2024 as it did at the end of 2023,” Slant Research said.

“Similarly, progress in the first 10 weeks of 2025 lags far behind where the brand was tracking at the same stage in 2024.”

Change in South Africa’s online clothing market

As Shein’s market share decreased in 2024, Takealot sold Superbalist to a consortium of private equity investors, including Blank Canvas Capital and KLT.

Before Shein and Bash Online were launched in South Africa, Superbalist was one of the largest online-only apparel retailers in South Africa.

Despite this, the business has struggled to achieve profitability, a problem compounded by Shein’s rapid entry and scale.

“There’s more bad news. Our data suggests that Superbalist’s market share has slipped even further since mid-2024,” Slant Research said.

“Consequently, in the decline of both Shein and Superbalist’s market share, the total market share for online-only retailers in South Africa is lower today than at the same point in 2024.”

The only retailer that seems immune to this slump is Bash, which has steadily increased its market share over the past 18 months.

This article was first published by Daily Investor and is reproduced with permission.