People saying goodbye to Eskom

South African households and companies continue to invest in alternative energy sources and reduce their reliance on Eskom for electricity.

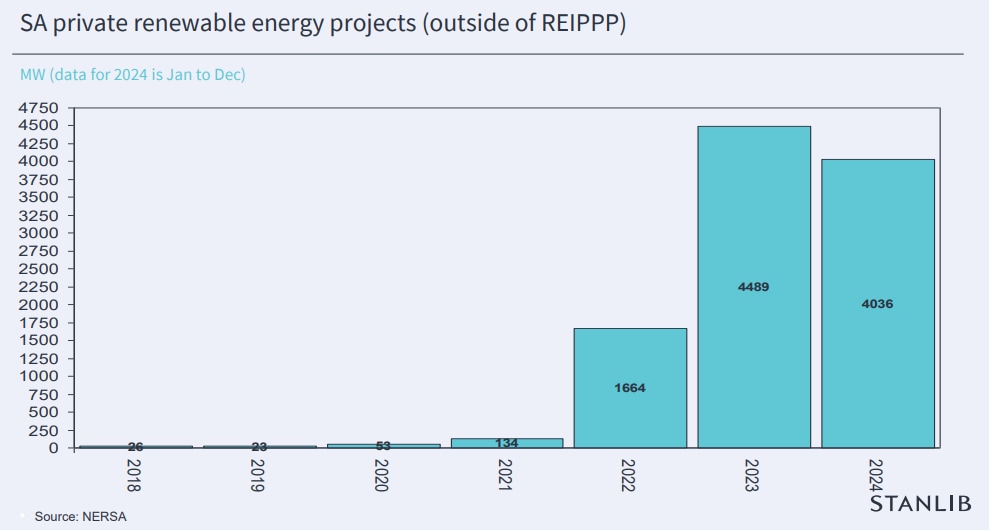

In 2024, the National Energy Regulator of South Africa (Nersa) registered a record number of private-sector power projects: 469 projects with a combined capacity of 4,036 MW.

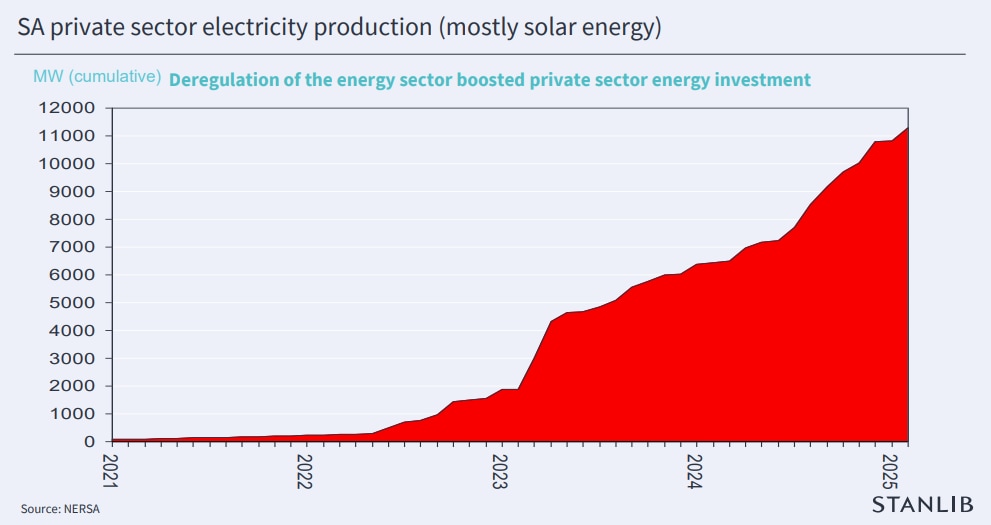

This followed two consecutive years of over 400 projects being registered with the regulator, bringing the total capacity to over 11,000 MW.

Crucially, this exceeds the private electricity generated as part of the government’s Renewable Energy Independent Power Producer Procurement Programme (REIPPPP).

Stanlib chief economist Kevin Lings explained that this shows what can be done when a sector is deregulated to enable private sector investment.

Lings said at Stanlib’s InPerspective Roadshow that the same approach needs to be applied to other sectors of the economy to truly drive economic growth.

“The biggest success story of this is obviously if we look at our electricity development. When they deregulated the sector, the private sector stepped in and has built a huge amount of energy infrastructure.”

“It demonstrates that if you deregulate, the private sector will step in and invest. The argument is to do that for all the infrastructure where we have a major backlog.”

“The private sector has the balance sheet, and it wants to invest. If the government stepped away and deregulated sectors to allow the private sector more, we are convinced that we will get the investment needed to lift the growth rate.”

These interventions in key sectors of the economy will not only unlock growth from investment but also improve efficiency and make it easier to do business in South Africa.

In turn, this will create a positive feedback loop, crowding in further investment and driving growth.

The graphs below, courtesy of Lings, shows the rapid growth of South Africa’s private electricity production.

Why South Africans are dumping Eskom

Alternative electricity sources are seeing renewed demand in South Africa despite significantly reduced load-shedding since March 2024.

Rooftop solar installations more than doubled in South Africa at the height of load-shedding in 2023 but have slowed sharply as Eskom’s operational performance improved.

With load-shedding seemingly near its end, some questioned whether it was necessary to install alternative energy sources.

However, South Africans are again turning to solar power due to elevated electricity prices.

The rising price of electricity has made solar installations, in particular, far more economically viable, with consumers turning to them to reduce their monthly electricity bills.

The executive head of Standard Bank LookSee, Marc du Plessis, explained that the platform has seen rising interest in solar installations since July 2024 as municipalities rolled out their annual hikes.

Du Plessis said LookSee expects this trend to continue as households look for sustainable ways to protect their budgets.

“We continued to see a steady increase with additional spikes in interest following reports that Eskom would continue asking for another significant increase in electricity tariffs.”

This renewed interest tripled the average number of visits to LookSee’s Solar Loan finance page.

Du Plessis explained that while the price of electricity from Eskom is rising, the price of installing a solar system is coming down in some cases.

Lower component prices and enhanced finance options have improved the affordability – and thereby accessibility – of residential solar installations, driving increased demand.

“With demand at more manageable levels, we have seen the cost of components dropping by up to as much as 30% since the beginning of the year.”

Demand for alternative energy sources is only set to rise further as periodic load-shedding has been implemented in 2025, and a 12.74% electricity tariff hike came into effect on 1 April.

This article was first published by Daily Investor and is reproduced with permission.