Electricity price pain for the South African Reserve Bank

South Africa’s electricity prices have risen by over 600% since 2008, consistently outpacing headline inflation, pushing prices higher and making it more difficult for the Reserve Bank to cut interest rates.

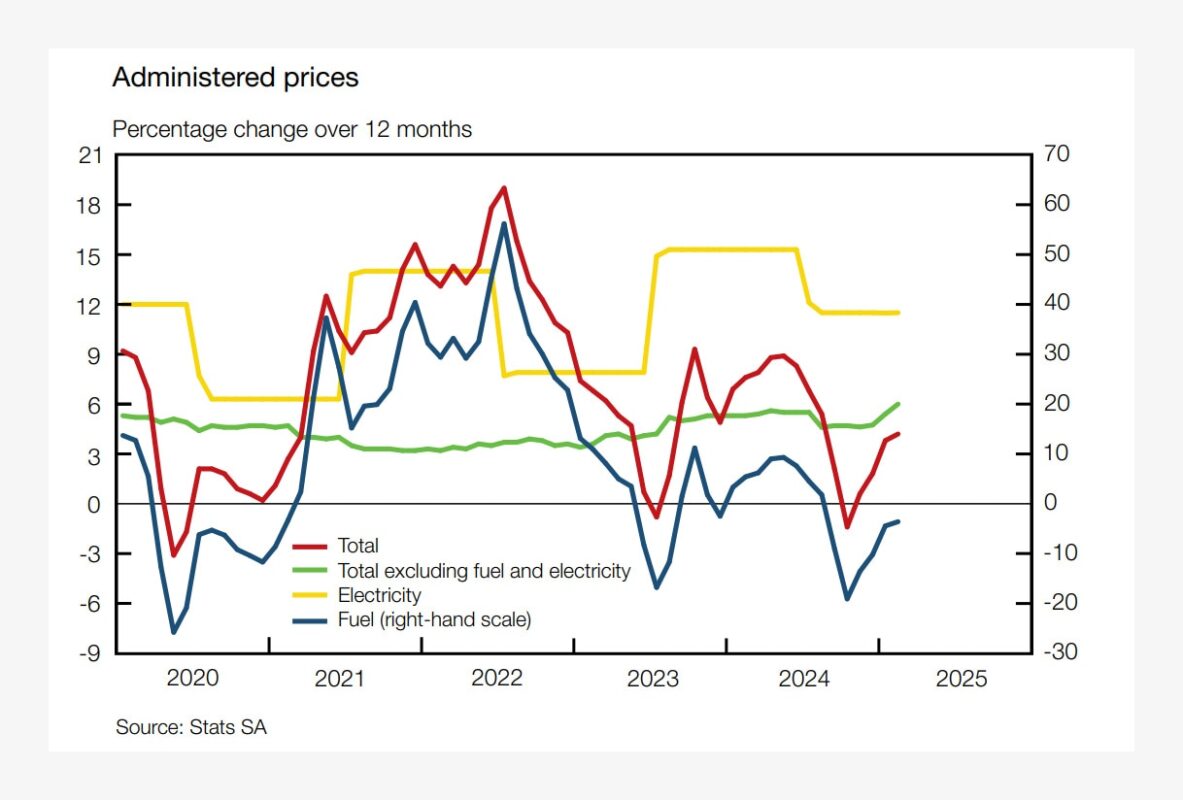

Inflation cooled substantially throughout 2024, dropping below 3% in October and November as food and energy price increases slowed.

It picked up slightly in 2025, rising to 3.2% in February as petrol price increases began to push prices higher and food inflation picked up off a low base.

The decline in fuel prices towards the end of 2024 staved off much higher inflation as they actually dragged administered price increases into negative territory.

Administered services range from electricity tariffs to municipal charges and significantly impact inflation as many of these services are universal inputs in the economy.

Thus, when the price for these services rises, the entire cost base of the economy rises, too. Electricity price increases and fuel prices are particularly impactful in this regard.

Data from the Reserve Bank shows that electricity prices have risen by around 12% year-on-year since the onset of the pandemic in 2020.

This has kept inflation consistently elevated, only being undone by sharply declining fuel prices in 2023 and 2024.

Administered price inflation moderated for most of 2024, decreasing from a high of 8.9% in May to -1.4% in October, largely weighed down by lower fuel prices, the Reserve Bank said in its Quarterly Bulletin.

Thereafter, administered price inflation accelerated to 4.2% in February 2025 as fuel price inflation became less deflationary.

When excluding fuel prices, administered price inflation remained elevated but eased from 8.6% in May 2024 to 7.7% in February 2025.

This is far above the headline inflation rate of 3.2% for February and, crucially, much higher than the midpoint of the Reserve Bank’s 3% to 6% target range.

Load-shedding pushes prices higher

Economists have warned that there are still structural drivers of inflation despite price increases coming down significantly towards 3% in 2024 and only rising marginally so far in 2025.

Momentum Investments chief economist Sanisha Packirisamy explained that an aggressive and deep-cutting cycle could reignite inflation, justifying the Reserve Bank’s cautiousness.

She explained that there were severe structural drivers of inflation that continued to put upward pressure on prices.

Chief among these is electricity tariffs, which have consistently risen above the headline inflation rate for the past 16 years.

According to calculations from Momentum Investments, electricity prices have risen by over 600% since January 2008. This is compared to a headline inflation rate of 139% over the same period.

Higher electricity tariffs have been combined with increases to other administered services such as municipal charges, and water tariffs.

Apart from the impact of these price increases on inflation, they also negatively impacts economic growth as it raises the cost of doing business, which is ultimately passed on to the consumer.

The Council for Scientific and Industrial Research (CSIR) explained that the sharp rise in electricity prices coincided with the beginning of load-shedding in 2008.

As South Africa’s historical coal-fired power stations became unreliable, Eskom was forced to rely heavily on open-cycle gas turbines (OCGTs) to manage load-shedding.

These plants are designed as peaking stations, intended to be used on short notice during temporary periods of high demand and not as a constant electricity source.

OCGTs are significantly more expensive to run, operating on diesel, and Eskom’s increasing reliance on them pushed up its cost of producing electricity.

As South Africa’s electricity tariffs are cost-reflective, the price soared, Eskom’s costs rose, and sales declined due to load-shedding.

South Africa experienced mammoth electricity price increases from 2008 to 2010, with the average annual rise during this period being above 20%.

While price increases have slowed from this peak in the last decade, they remain above inflation, and since load-shedding picked up from 2018 onwards, so have the size of the increases.

Since 2014, the average electricity tariff in South Africa has risen by 190%. This excludes the proposed tariff increase of 12.74% in 2025.

This article was first published by Daily Investor and is reproduced with permission.