Data price concern in South Africa

While prepaid mobile data bundle prices have decreased since 2020, this change has stagnated over the past few years.

This can be attributed to several macroeconomic factors that have impacted South Africa’s mobile networks over the past few years.

The Independent Communications Authority of South Africa released its State of the ICT Sector Report at the end of March, which includes an analysis of the lowest data bundle prices.

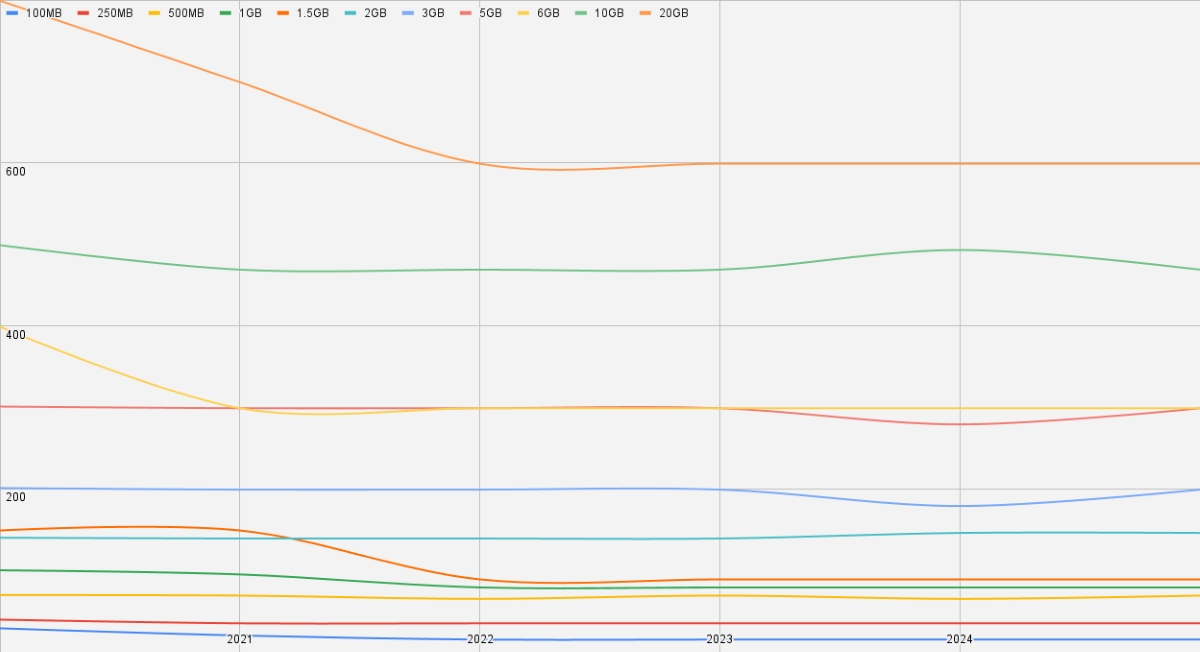

Most of the bundles, ranging from 100MB to 20,480MB, saw significant price decreases from 2020 to 2022.

For instance, the 100MB bundle dropped from R29 in 2020 to R15 in 2022, the 1,536MB bundle from R149 to R89, and the 1,024MB bundle from R100 to R79 over the same period.

However, over the following three years, no bundle included in the analysis saw a price decrease, with some even increasing throughout the period.

The price of the 100MB, 250MB, 1GB, 1.5GB, 3GB, 5GB, 10GB, and 20GB bundles remained the same between 2022 and 2025.

On the other hand, the 500MB bundle increased from R65 to R69, while the 2GB bundle went up from R139 to R146 over the same period.

Icasa said this pricing variability “can be attributed to market dynamics and competitive strategies employed by service providers.”

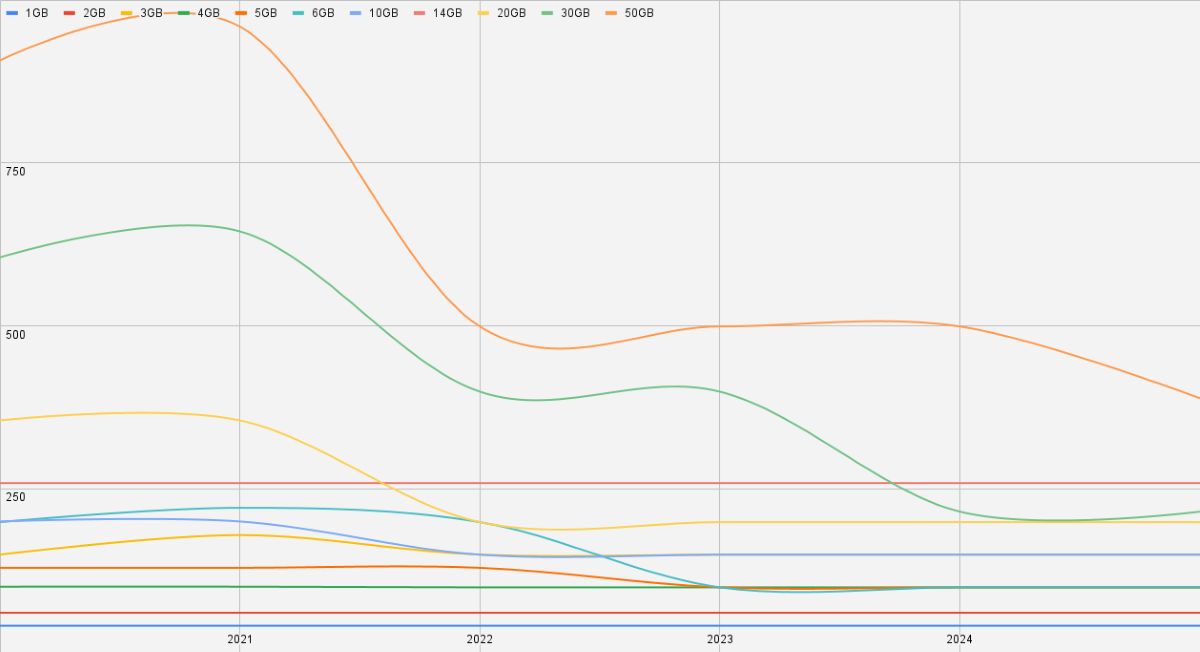

A similar trend was noticed for the lowest postpaid data prices collected by Icasa from 2020 to 2025, which remained cheaper than prepaid prices.

However, the exception was that specific quantities saw a significant drop in price, while most stayed stagnant.

The prices of the 1GB, 2GB, 3GB, and 14GB allocations remained the same from 2020 to 2025. The 4GB allocation could be considered part of that group, as it only decreased by R1.

However, the 50GB, 30GB, and 5GB allocations more than halved over the period.

For instance, the most affordable 50GB allocation decreased from R907 to R389, the 30GB from R605 to R215, and the 5GB from R199 to R99.

Other allocations saw less significant decreases, such as the 6GB from R129 to R99, the 10GB from R200 to R149, and the 20GB from R355 to R199.

The charts below show how the prices of prepaid data bundles and postpaid data allocations have changed since 2020.

Cable.co.uk’s findings

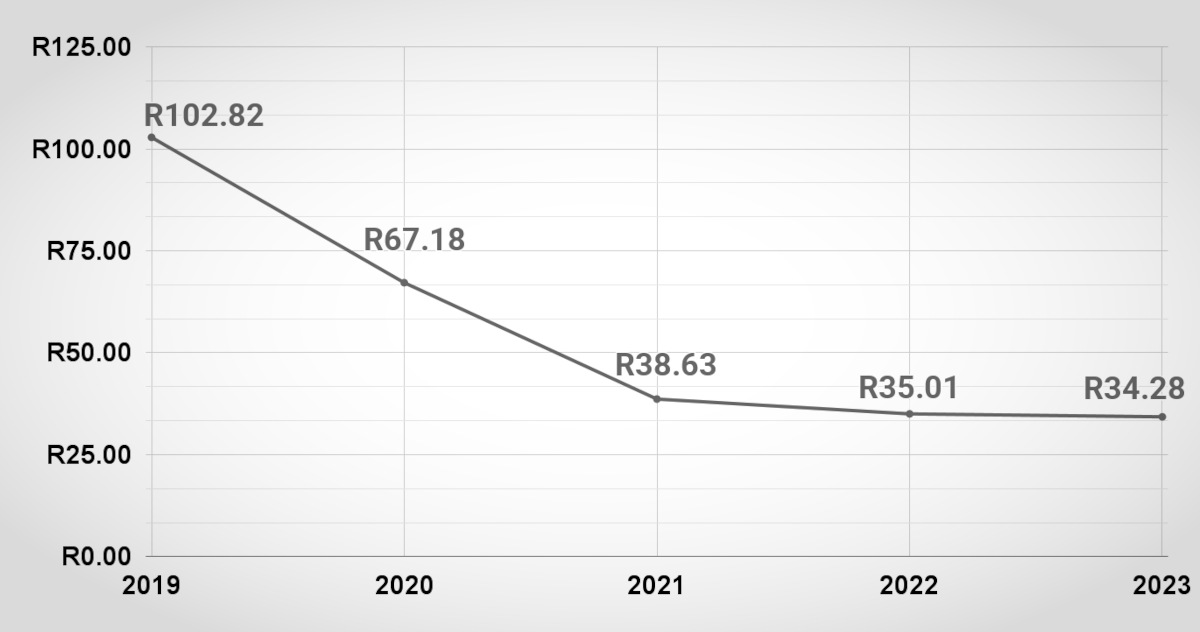

Data from Cable.co.uk’s latest mobile data price report, which analyses mobile data plans from hundreds of nations worldwide, revealed a similar trend compared to previous years.

Cable.co.uk’s 2019 report analysed prices across over 6,000 mobile plans worldwide between 23 October and 28 November 2018.

The average price of 1GB of mobile data in South Africa was $7.19 (then R102.82).

Prices dropped considerably between November 2018 and February 2020, when Cable.co.uk’s data revealed the average price in South Africa was $4.29 (then R67.18) per GB.

Another significant price drop was seen between February 2020 and March 2021. Cable.co.uk’s 2021 report revealed that the average price of 1GB of data had dropped to $2.67 (then R14.47).

While the average dollar price has dropped significantly since 2021, from $2.67 to $1.81 per GB, the rand weakened substantially between 2021 and 2023.

This meant the average price in rands wasn’t much lower in 2023 than in 2022 and 2021.

For reference, the dollar price dropped to $2.04 (then R35.01) in 2022 and $1.81 (then R34.28) in 2023.

Although South Africa ranked among the more expensive countries for mobile data, residents are far better off than in neighbouring Zimbabwe.

Zimbabwe had the highest price per 1GB of data of all countries in the report.

The average cost of 1GB of data in Zimbabwe was $43.75 (R802.82), roughly 24 times the price paid in South Africa.

Israel had the most affordable 1GB mobile data price at $0.02 (then R0.37).

The chart below tracks the average price of 1GB of mobile data in South Africa from 2019 to 2023 using Cable.co.uk’s price data.

Tough macroeconomic climate

Tough macroeconomic conditions, such as high interest rates, high unemployment, and inflation, remain a constant challenge for mobile operators in South Africa.

In its latest annual results for the 2024 financial year, MTN South Africa alluded to macroeconomic headwinds as the reason for a challenging trading environment.

“The South African economy remains under some pressure given the high levels of unemployment

and sluggish GDP growth,” the mobile operator stated.

“With the improved trends in inflation and the recent interest rate reductions, there is some optimism on the consumers’ ability to increase economic activity.”

Similarly, Vodacom South Africa noted that its revenue growth of 2.6% to R61.6 billion reflected ongoing macroeconomic challenges.

“The resilience of our strategy was tested again in the current financial year as we faced high inflation and interest rates, energy cost inflation and uncertainty, and foreign exchange rate volatility,” Vodacom said.