Discovery Bank reveals information about banking security in South Africa

Discovery Bank has warned that fraud is on the rise in South Africa. Many individuals have experienced card fraud or received a scam email.

The tactics employed by fraudsters are also becoming increasingly complex and more sophisticated, requiring greater levels of security.

As a result, many South Africans are switching to virtual cards and digital wallets due to their enhanced security and greater convenience.

This was revealed in Discovery Bank and Visa’s SpendTrend 25 report, which outlined the spending habits of South Africans.

The report combines data from the bank and Visa cardholders across South Africa and select global cities, with information from over 2.6 billion transactions analysed.

To enhance the findings of the SpendTrend25 report, Visa and Discovery Bank conducted a public survey facilitated by an independent research group to capture consumer perspectives on spending and payment behaviours.

The survey included 1,000 South African respondents from various local banks, all earning over R100,000 per year and actively using a credit card.

A soft quota was applied to ensure a mix of age groups, geographic representation across key cities and representation across local banks.

It revealed that South African consumers remain under immense pressure despite declining interest rates and a much lower headline inflation rate.

One of the other key findings was the increased focus from South Africans on the security of their spending methods and bank accounts.

Over 60% of respondents in Discovery Bank and Visa’s survey said that they are more worried about banking security now than a year ago.

63% said they have experienced or know someone affected by card fraud, with over 75% having received scam emails, texts, or calls.

Despite this, many still trust their bank to protect their money and data and believe that fraud protection from their bank is essential.

How South Africans protect themselves

Discovery Bank explained that many people are turning to digital wallets and virtual cards for added security to protect themselves from rising fraud attempts.

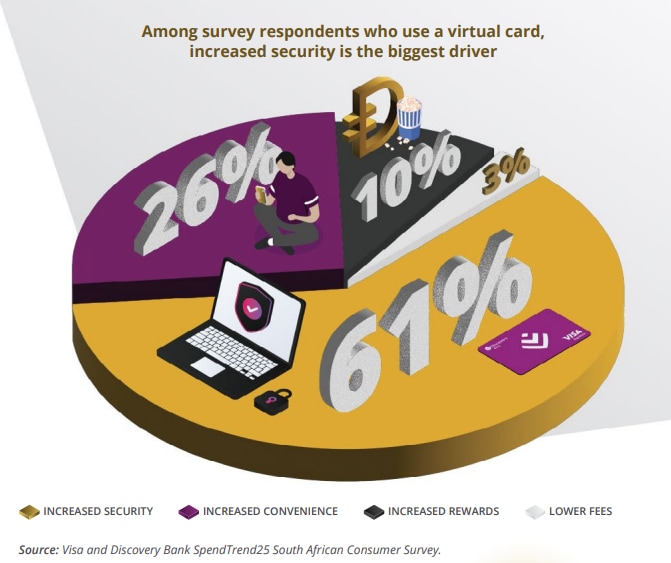

Virtual cards are gaining popularity as a secure and convenient payment method. According to the survey, 45% of respondents currently use a virtual card, while some own one but don’t use it, indicating a need for more education on its benefits.

Virtual cards are gaining popularity for their security, convenience and versatility. As with physical cards, they can be used in-store, online, and in-app, but they are also safer to protect sensitive information.

Virtual cards are even more convenient. They are issued to clients instantly in their banking app, allowing clients to transact immediately instead of waiting for a physical card to be delivered.

As fraudsters become more sophisticated at targeting online payments, virtual cards are increasingly being favoured for their enhanced security and control over spend, making them a top choice for digital transactions.

A similar trend is being noticed with digital wallets as South Africans ditch physical banknotes and cards for mobile payments.

As trust in mobile payments grows and more retailers support them, digital wallets are quickly becoming the preferred way to pay.

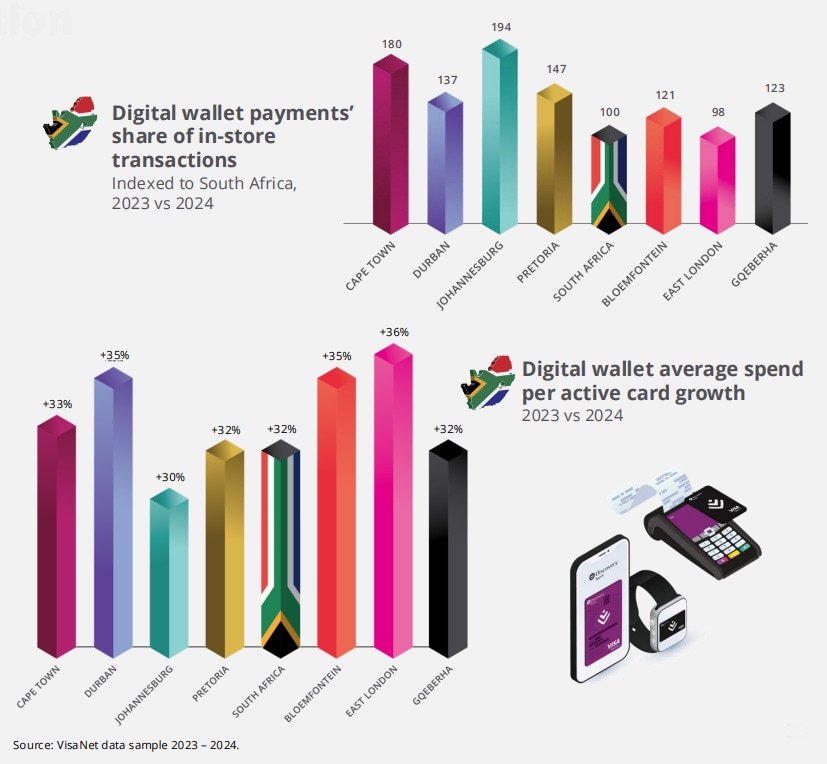

In 2024, digital wallets’ share of in-store purchases grew by another 9%, matching 2023’s increase.

According to the PayFast State of Pay 2024 Study, digital wallets like Samsung Pay and Apple Pay now account for 22% of transactions – a number set to rise as consumers prioritise speed, simplicity and security.

This shift is especially strong in Johannesburg and Cape Town, where digital payments are becoming the norm.

The Visa Stay Secure Study 2025 reports that 68% of South Africans plan to use digital payments even more in the next year.

This study showed that 84% of South African consumers use digital payments because they feel safer verifying their identity through two-factor authentication.

This article was first published by Daily Investor and is reproduced with permission.