Interesting information about South African fibre networks revealed

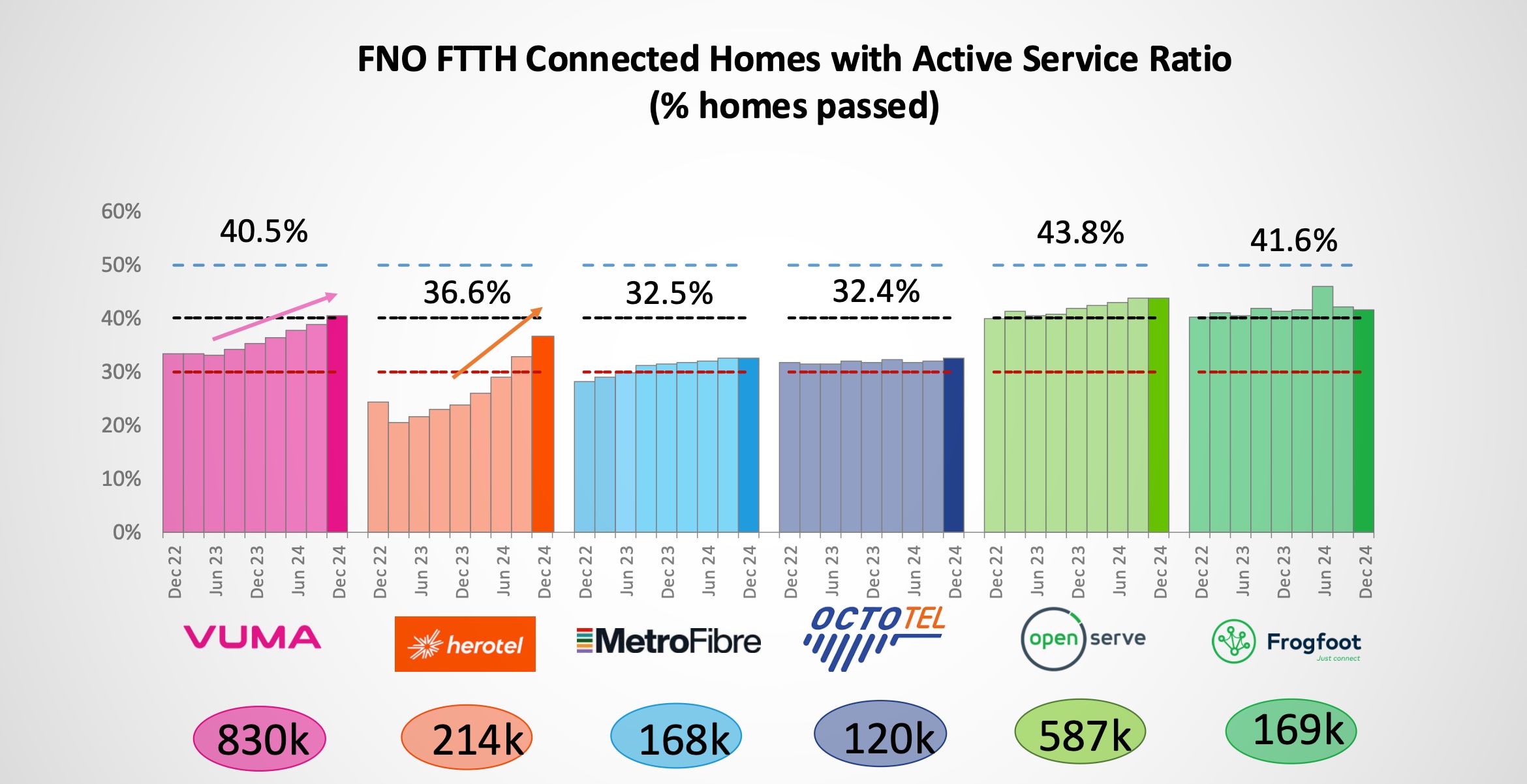

Vumatel and Herotel have over 40% market share in South Africa’s fibre-to-the-home (FTTH) sector.

This is according to data shared by Maziv’s chief commercial officer, Phila Dube, during Remgro’s recent Capital Markets Day presentations.

Remgro has a 57% effective interest in Community Investment Ventures Holdings (CIVH), the parent company of Maziv.

Maziv, in turn, is the parent company of Vumatel and DFA. Vumatel currently owns 49% of Herotel. Vumatel has been given conditional approval by the Competition Commission to acquire the rest of Herotel.

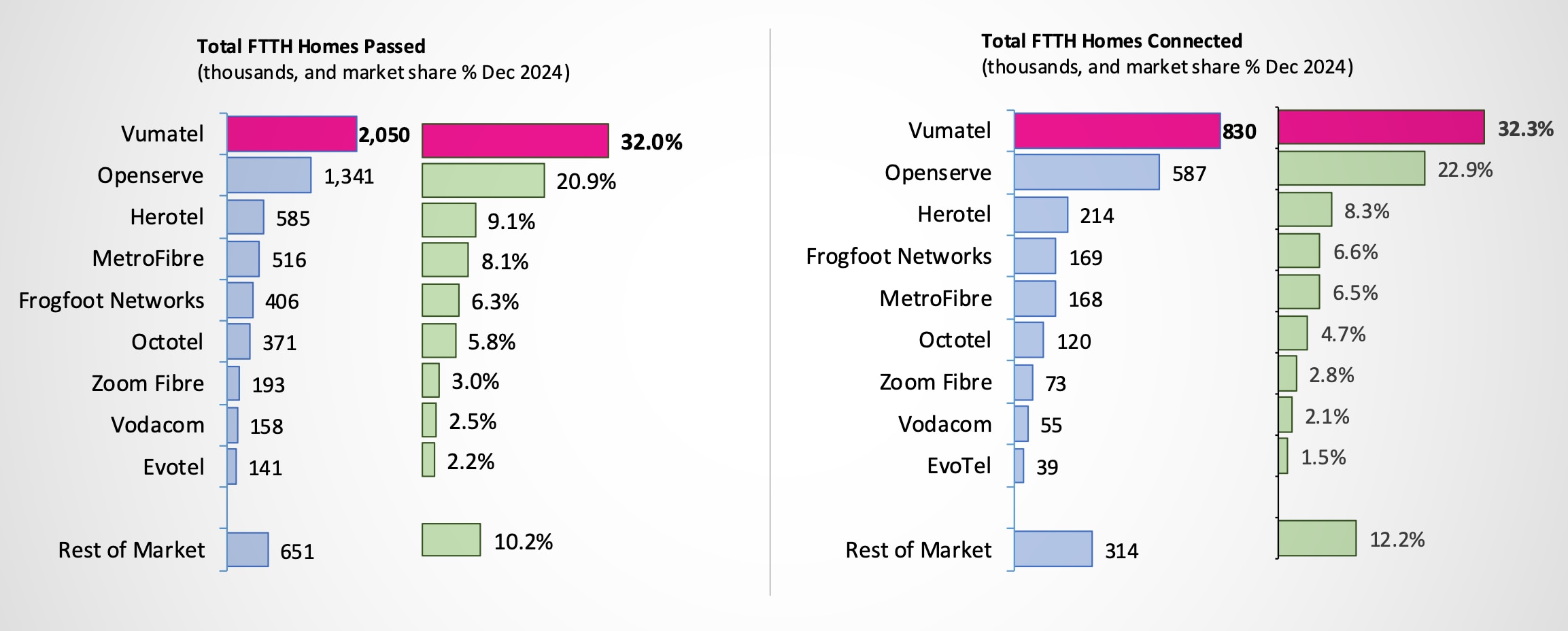

Citing Africa Analysis, Dube said Vumatel alone had 32% FTTH market share in terms of homes passed and homes connected as at December 2024.

Homes passed refers to residential locations that can be connected to a provider’s network, whereas homes connected is a measure of households with fibre lines installed.

“A 32% market share in a market with 38 major fibre network operators (FNOs) is really significant,” Dube stated.

“And we are not just leading at 32% — we are one and a half times the size of the next biggest competitor in that space.”

Telkom’s Openserve is the second-place FNO, with a 20.9% market share in homes passed. It has 22.9% of the homes connected market share.

Vumatel was not always larger than Openserve. Its market share required billions of rands of investment and relentless effort.

While Vumatel may be a household name now, ten years ago, that was not the case.

Vumatel’s breakthrough came in 2014 when the Parkhurst Residents and Business Owners Association took a chance on it to build fibre in the neighbourhood.

Parkhurst had issued a tender for someone to supply fibre after growing frustrated with Telkom’s expensive and deteriorating DSL services.

While a few small private fibre network operators were active at the time, these were predominantly rolling out in more affluent estates and gated communities.

These fibre providers also generally focused on “greenfield” residential complexes that were still under construction.

Vumatel and Parkhurst showed that the models being used to determine the financial feasibility of suburban fibre rollouts were flawed.

Parkhurst also proved there was consumer demand by conducting a survey among community members, and its tender showed that many operators were willing to build them a network.

It ignited a craze among South Africa’s leafy suburbs. Several had soon published their own tenders.

A fibre landgrab ensued, and it soon became unnecessary for neighbourhoods to get the attention of fibre network operators through tenders.

By March 2019, just under five years after Parkhurst, Vumatel overtook Openserve as the largest fibre-to-the-home provider in South Africa in terms of homes passed.

This was despite Telkom’s clear advantage thanks to its head start. Even though it is second in FTTH, Openserve’s fibre network still dwarfs those of its competitors.

Telkom has over 170,000km of fibre in the ground, while Maziv’s combined network is around a third of the size, spanning over 57,000km.

When considering Vumatel and Herotel’s combined market share of over 40%, Maziv’s lead over Telkom is even larger.

It should be noted that the Africa Analysis data did not show Vumatel and Herotel’s combined market share. Maziv and Remgro have assured that the two fibre operators will not be integrated.

Although Vumatel and Herotel continue to operate completely independently with entirely different business models, it is still interesting to see their combined market share.

The table below summarises the market share of South Africa’s nine largest FNOs based on their homes passed and connected as of December 2024.

| Fibre network operator | Homes passed | Homes connected | ||

|---|---|---|---|---|

| Homes | Market share | Homes | Market share | |

| Vumatel + Herotel | 2,635,000 | 41.1% | 1,044,000 | 40.6% |

| Vumatel | 2,050,000 | 32.0% | 830,000 | 32.3% |

| Openserve | 1,341,000 | 20.9% | 587,000 | 22.9% |

| Herotel | 585,000 | 9.1% | 214,000 | 8.3% |

| Metrofibre | 516,000 | 8.1% | 168,000 | 6.5% |

| Frogfoot | 406,000 | 6.3% | 169,000 | 6.6% |

| Octotel | 371,000 | 5.8% | 120,000 | 4.7% |

| Zoom Fibre | 193,000 | 3.0% | 73,000 | 2.8% |

| Vodacom | 158,000 | 2.5% | 55,000 | 2.1% |

| Evotel | 141,000 | 2.2% | 39,000 | 1.5% |

| Rest of Market | 651,000 | 10.2% | 314,000 | 12.2% |

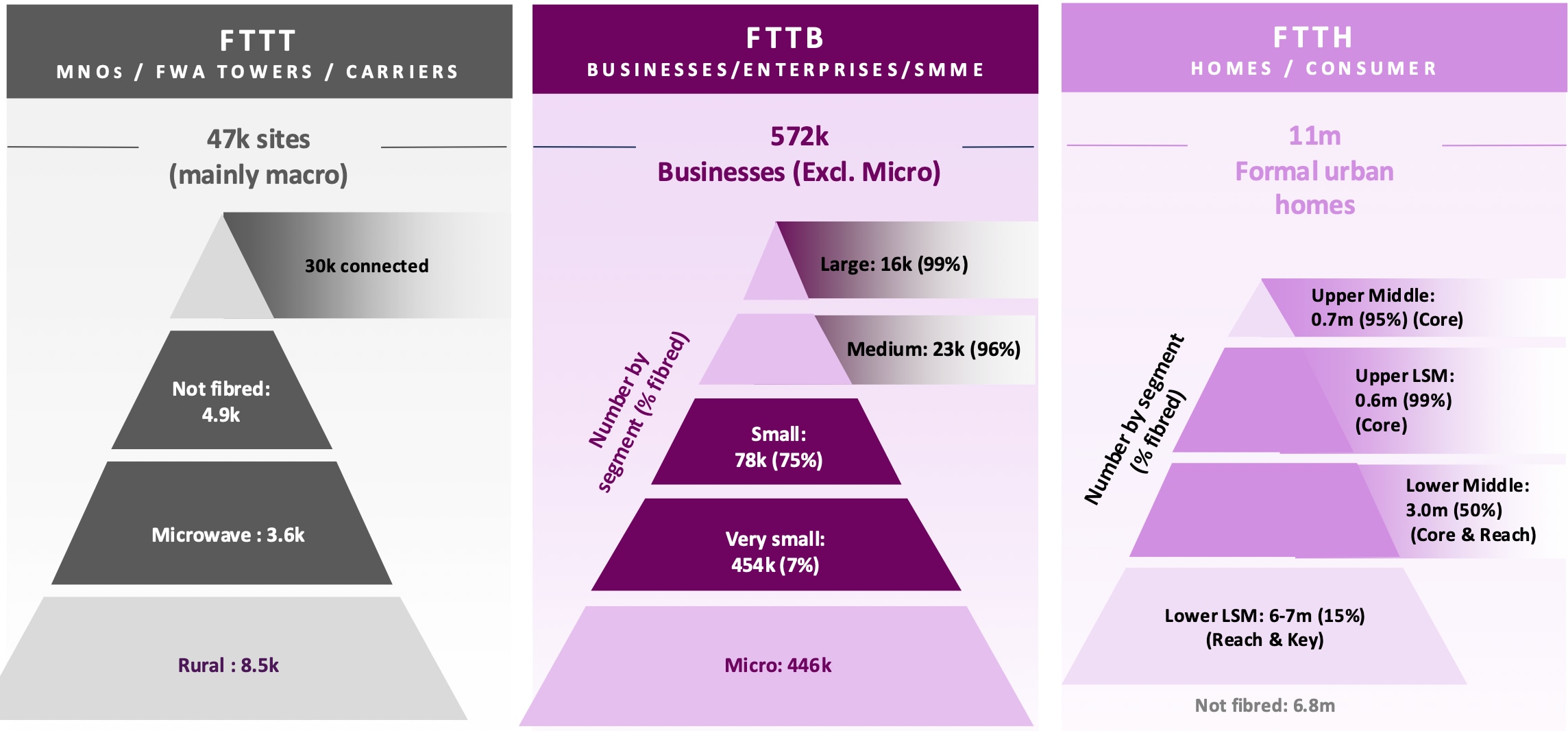

Fibre for carriers, enterprise, and small business

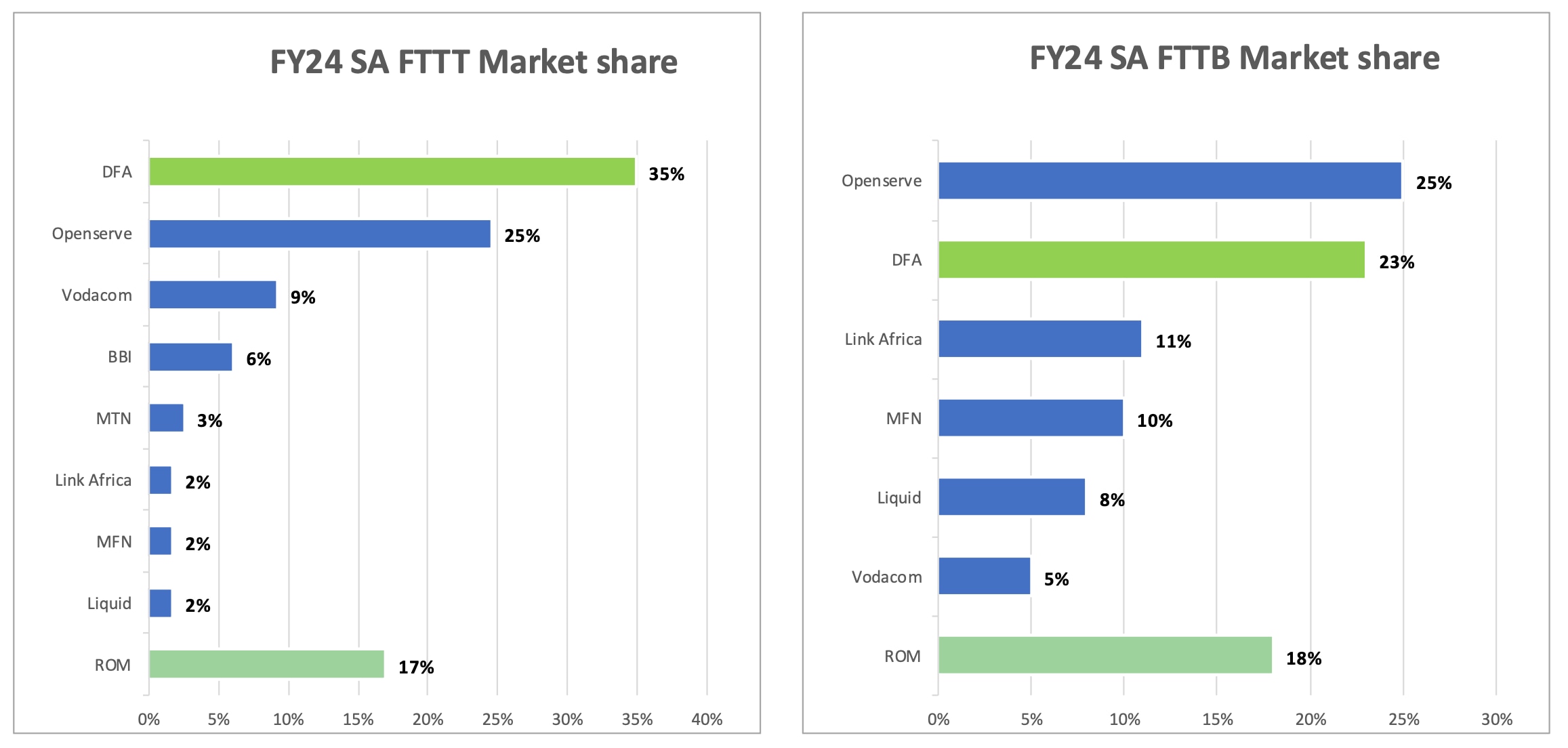

Regarding Maziv’s enterprise market share, Dube relied on BMI-T’s 2023 Wholesale Telecoms Report.

This showed that Maziv subsidiary DFA led in the fibre-to-the-tower sector with a 35% market share, with Openserve again coming second with 25%.

However, Openserve maintains its lead with 25% market share in fibre-to-the-business while DFA is hot on its heels with 23%.

“When I look at the growth we are seeing, we are well-positioned to be number one within the next two years,” Dube said.

“South Africa has 572,000 businesses registered currently. Of those, the top end — just more than 100,000 — have already been connected. That’s the corporates and large enterprises.”

He said there was still an opportunity for about 450,000 businesses to be connected to fibre so they could digitise, access cloud services, and grow.

South Africa’s fibre market

Regarding South Africa’s residential fibre market, Dube said there were over 18 million households in the country, and 6.4 million had been passed with fibre.

Taking network overlap into account, Dube said only 5.4 million unique homes had access to a fibre connection in South Africa.

Stated differently, only about 30% of South African households in urban areas currently have access to fibre broadband.

Dube said the data shows that 95% of the roughly 700,000 households in the upper-middle income segment were covered.

Similarly, 99% of the 600,000 households in the upper Living Standards Measure (LSM) market segment could get fibre.

Penetration in the lower-middle segment was much lower, with around 50% of the 3 million households in that market passed with fibre.

The lower-income segment was even worse, with only 15% of households with access to fibre broadband.

“That presents to us another opportunity of 11 million homes still to be passed with fiber,” Dube said.

“There’s also probably about half a million micro businesses that also have to be connected in that same market.”