Big changes at South African fintech company ranked among the best in the world

Last year, Old Mutual’s personal financial management service, 22seven, underwent a total rebrand, including changing its name to Vault22.

In an email to users, the company announced that 22seven had become a member of Vault22 Solutions Holdings, a Dubai International Financial Centre (DIFC) registered entity, headquartered in the UAE.

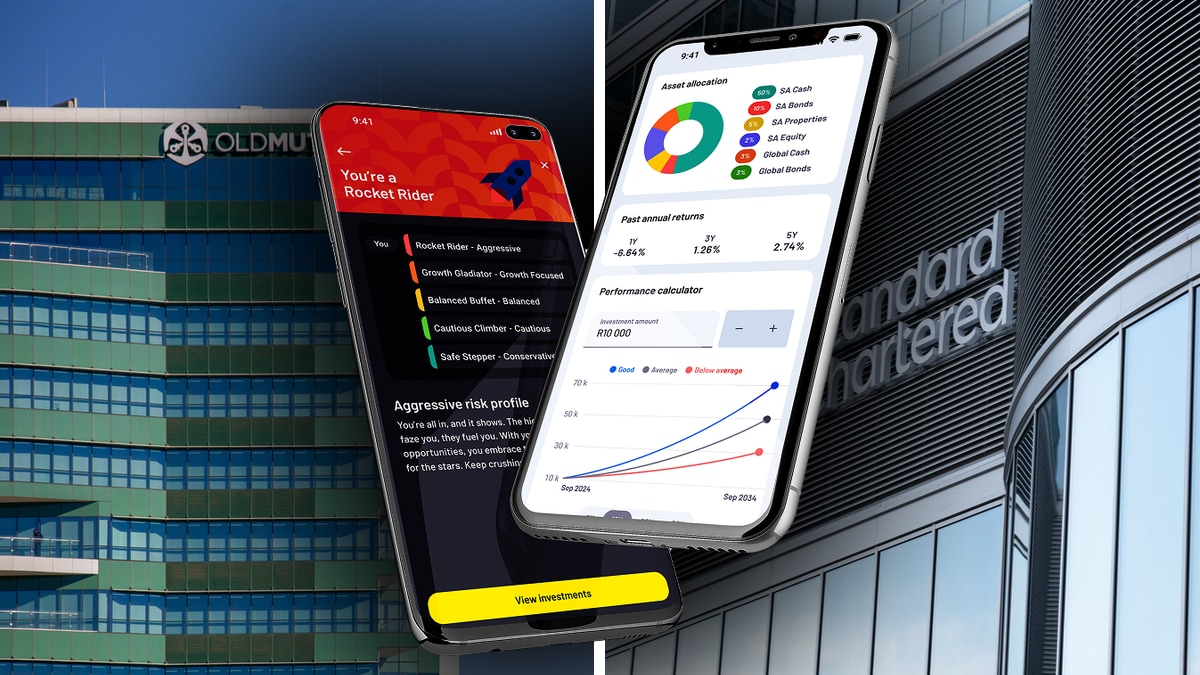

Shortly after the announcement, SC Ventures and Old Mutual announced that they had joined forces to merge their two apps, 22seven and Autumn.

22seven fell under the umbrella of Old Mutual’s venture capital firm Next176 and brought the financial information aggregation and budget tracking functionality to the partnership.

As for Autumn, the companies said Standard Chartered’s app brought financial goals and wealth planning to the combined Vault22 offering.

22seven’s history dates back to 2011 when Christo Davel and Kenny Inggs founded the company as a personal financial management tool based on behavioural economics principles.

It launched a public beta in January 2012, exiting from its test phase in May.

Old Mutual acquired 22seven in January 2013, and Davel and Inggs left the company in March 2017.

In 2023, 22seven ranked among the world’s 200 best fintech companies, alongside prominent global corporates like Robin Hood, Tencent, Stripe, PayPal, and SoFi in a list compiled by CNBC and Statista.

It featured among the top 20 in the digital financial planning space with NerdWallet and Credit Karma. Vault22 did not place in the top 20 financial planning apps for CNBC and Statista’s 2024 ranking.

More recently, Vault22 began adopting open banking technology in South Africa, starting with integrating Capitec’s Accounts Services API.

“The Capitec integration has been our most requested feature, and we’re thrilled to deliver on our promise to our users,” said Vault22 CEO Benito Mable.

Vault22 said it was Capitec’s first proof-of-concept partner for the bank’s Accounts Services API.

“This partnership with Capitec marks a turning point for financial accessibility in South Africa,” Mable said.

“By embracing open banking principles, we’re putting power back into consumers’ hands, allowing them to make more informed decisions about their money in a country where financial literacy remains a critical challenge.”

Vault22 said open banking represents a paradigm shift in how financial data is managed and used.

“South Africa’s financial sector has traditionally been dominated by a few major banks, limiting competition and consumer choice,” it said.

“Open banking disrupts this model by allowing consumers to securely share their financial data with authorised third parties, fostering innovation and creating more personalised financial services.”

Vault22 Wealth platform

Coinciding with the Capitec integration, Vault22 also launched its Wealth platform.

Vault22 said this expanded the company’s mission beyond financial tracking and budgeting to actively helping users build and grow their wealth.

“This launch represents a major pillar in Vault22’s growth strategy and transforms the platform into a comprehensive financial ecosystem,” it said.

“Financial health isn’t just about tracking expenses—it’s about actively growing your wealth and securing your future,” said Mable.

“With our Wealth platform, we are empowering South Africans at all income levels to take that crucial next step from managing money to making it work harder for them.”

Vault22 then introduced an Active ETF offering from Coronation and Prescient, complemented by a partnership with Absa.

“This development brought together Coronation’s investment heritage and Prescient’s precision-driven approach, offering everyday South Africans unprecedented access to professional wealth management,” the company stated.

Vault22 said its platform allows South Africans to begin investing using the instruments with a minimum of R500.

It announced Absa as its official execution, custodian, and banking provider, promising top-tier financial security, transparent transactions, and a seamless investing experience.